Private lending and your team

Categories: Blog Posts

Your Team

Private real estate lending is not a solo venture.

It requires the best team you can find to help you create the best note for you

and your family.

Private lending and your team.

Before we jump into who should be on your team, let’s remember that the cost of each one is normal for borrowers. They’re used to paying for these services. If anyone tries to talk you out of using one or all of these “teammates,” it’s probably a good idea to walk away and find someone else to lend your money to.

Below is the recommended minimum to get a loan properly closed.

Attorney. To make sure your paperwork is legal, proper and protects you.

Closing agent. A third party that handles the paperwork, filings, and money transfers. This is typically an attorney, escrow company, or title company.

Valuation services. A realtor or appraiser who provides an as-is value for the property.

Title company. Provides title insurance to insure you are in the proper lien position (preferably first lien position).

Insurance company. Provides protection from fire or other loss on the property.

You may also wish to hire the following:

Servicing company. Will collect payments and verify taxes and insurance are paid in a timely fashion.

Note company. Help find, underwrite, and close each loan.

Every closing and every state handle private notes/real estate differently, so it’s likely you will have a different team each of you will have a different team.

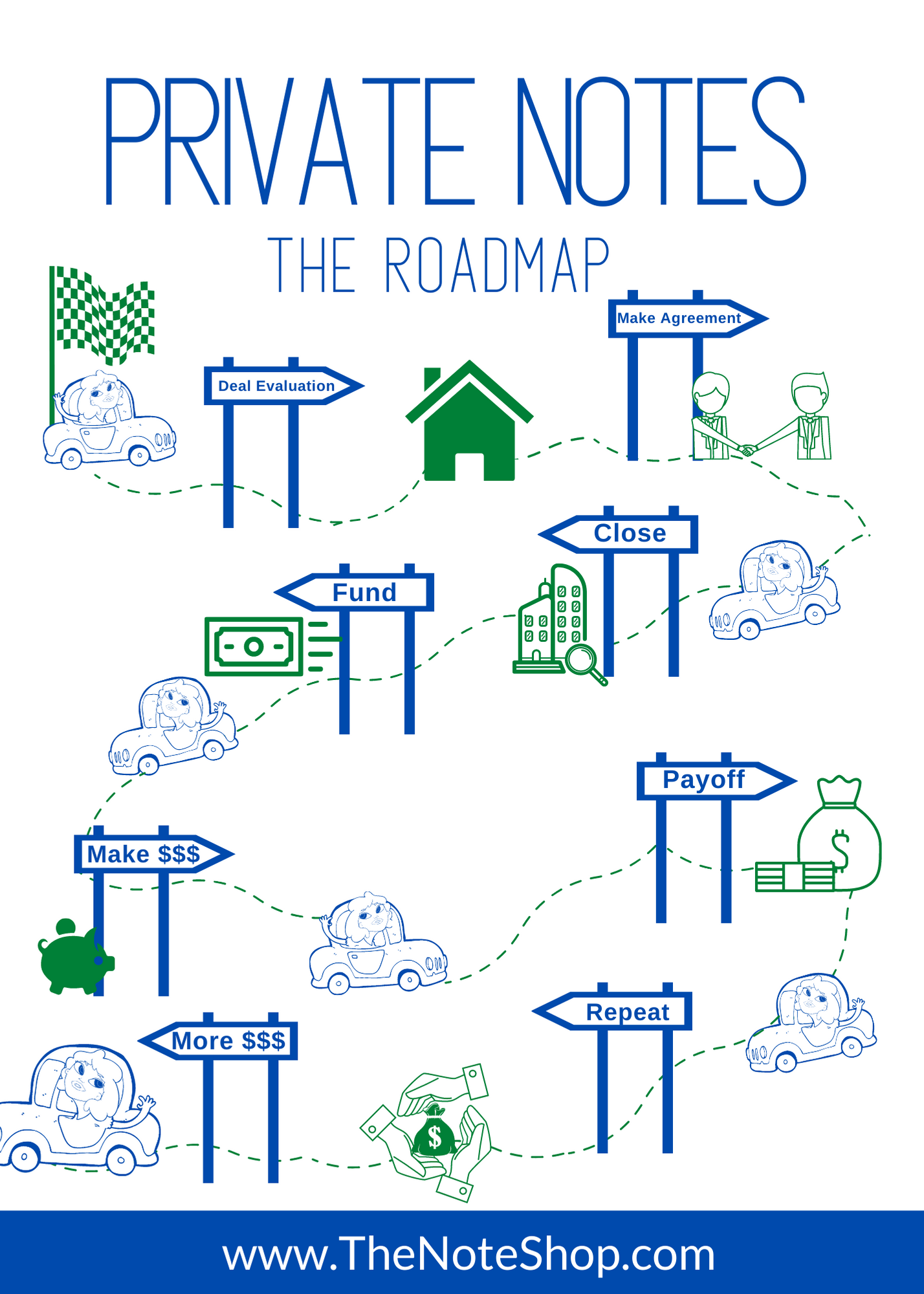

Step by step roadmap shows you the path of funding a private note.

Private lending and your team